Bali’s villa market in 2026 is no longer a playground for casual speculation; it has matured into a sophisticated hospitality sector where only data-driven operations thrive. Many foreign owners find themselves stagnating at 6–7% yields because they treat their property as a passive asset rather than a business.

The shift from “lifestyle holding” to “institutional-grade hospitality” is the critical leap needed to unlock the double-digit returns seen in top-performing corridors like Canggu and Uluwatu.

The gap between an average villa and a high-yield asset often boils down to structural compliance and revenue agility. Owners relying on outdated “nominee” arrangements or static pricing models are leaving significant money on the table while exposing themselves to regulatory risk. In a market where travelers increasingly prefer private villas over hotels, the opportunity to secure a 15% return on investment exists only for those who align with Indonesia’s tightening investment rules.

To sustainably boost your return on investment, you must build on a foundation of legal certainty and operational excellence. This involves securing the correct PT PMA structure, leveraging dynamic pricing, and enhancing the guest experience to drive direct bookings. This guide outlines the practical, proven steps foreign investors must take to transform their Bali property into a high-performance asset that delivers consistent, long-term wealth.

Table of Contents

Benchmarking Your Villa's Financial Potential

Before implementing changes, it is crucial to understand what a healthy return on investment looks like in the current market. In 2026, well-managed short-term rental villas in prime areas typically achieve annual yields between 8% and 15%. Standout properties with unique designs or those catering to specific niches like digital nomads can sometimes push towards 20%, driven by high occupancy and premium nightly rates.

However, these figures are not automatic. The primary drivers of high returns are micro-location, property condition, and, critically, management quality. A villa in a high-demand zone like Pererenan can underperform if it lacks professional marketing or rigorous maintenance. Understanding these benchmarks allows you to set realistic targets and identify whether your current performance gap is due to market conditions or operational inefficiencies.

Legal Structure: Why PT PMA is Non-Negotiable

For foreign investors, the days of using “nominee” structures to hold property are over. To sustainably secure your return on investment, you must operate through a PT PMA (Foreign Owned Company). This structure allows you to hold Hak Guna Bangunan (Right to Build) titles, providing clear legal ownership and the right to operate a commercial villa business. It eliminates the existential risk of a nominee claiming ownership or the government cracking down on informal arrangements.

A PT PMA also opens the door to formal banking, payment gateways, and legitimate contracts with OTAs. Without this structure, you are effectively operating in the grey market, vulnerable to sudden closure or fines that can wipe out years of profit. Ensuring your legal foundation is solid is the first and most important step in protecting the long-term value of your asset and its ability to generate income.

Navigating BKPM Investment Thresholds 2026

Setting up a PT PMA requires adherence to specific capital requirements set by the Indonesian Investment Coordinating Board (BKPM). Generally, foreign investors must realize an investment plan of IDR 10 billion per business classification (KBLI). While traditionally this excluded land and buildings, BKPM Regulation 5/2025 has introduced a critical update: for specific sectors like accommodation and property development, the investment value calculation can now include land and buildings.

This regulatory shift is a game-changer for mid-sized investors, making it easier to reach the compliance threshold without injecting excessive cash for operational costs alone. Meeting these thresholds creates a defensible moat around your business. By operating at this level, you ensure your licenses (NIB, standard certificates) remain valid, preventing the disruptions that plague under-capitalized, non-compliant operators.

Revenue Management for Maximum Yield

Static pricing is a “silent killer” of return on investment. To maximize income, you must adopt dynamic pricing strategies that adjust daily rates based on seasonality, local events, and competitor occupancy. Data shows that active revenue management can lift yields significantly—moving a property from a 6% return to over 10%. Instead of simply lowering prices, smart operators focus on capturing distressed demand at a discount to fill gaps that would otherwise generate zero revenue.

This agility extends to your channel strategy. While OTAs like Airbnb and Booking.com are essential for visibility, their 15-20% commissions eat directly into your net profit. A balanced strategy uses OTAs to fill the calendar but prioritizes direct bookings for repeat guests. Every booking converted to a direct channel improves your margin, directly contributing to a healthier bottom line.

Operational Upgrades That Drive ADR

Physical improvements are a reliable lever to increase your Average Daily Rate (ADR). In 2026, guests expect more than just a bed; they demand experiences. Upgrading a villa with a modern kitchen, high-speed fiber internet for remote work, or a private pool with “Instagrammable” features can justify a significant price increase. Smaller villas with premium finishes often achieve the highest percentage return on investment because they command luxury rates with lower operating costs.

Professional management is the glue that holds these upgrades together. A beautiful villa will still fail if the pool is green or the AC is broken. Outsourcing to a professional team ensures hotel-grade maintenance and 24/7 guest support. This operational rigor leads to better reviews, which in turn drives higher occupancy and pricing power, creating a virtuous cycle of growth for your asset.

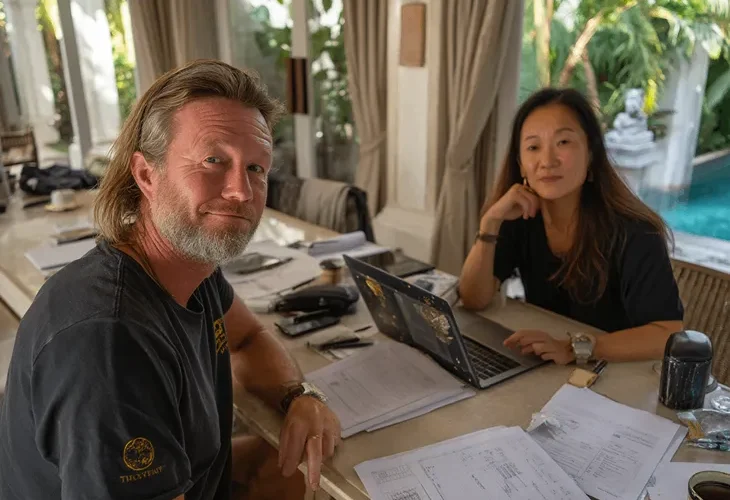

Real Story: The March 31st Deactivation Panic

James, a 48-year-old investor from Melbourne, owned a stunning three-bedroom villa in Bingin. For years, he operated comfortably under a personal name with a basic local license, enjoying decent returns. But in early 2026, the industry was rocked by a new policy: the March 31st Deactivation Deadline. Major OTAs announced they would delist any property without a verified business NIB and tourism license by that date.

James initially ignored the emails, assuming it was another “soft” regulation. But as the date approached, he saw competitors disappearing from search results. His bookings slowed, and the panic set in—he realized his entire revenue stream was about to be cut off. He was risking a total loss of income for the sake of avoiding compliance costs.

With only three weeks left, he contacted Bali Villa Management for an emergency audit. They rushed to restructure his asset into a compliant PT PMA, utilizing the BKPM Reg 5/2025 provision to include his land value in the investment plan. They secured his NIB just days before the deadline. While his non-compliant neighbors were wiped off Airbnb on April 1st, James’s listing remained live. In fact, his occupancy surged to 90% the following month because the supply of available villas had dropped so drastically. James learned that in 2026, the best ROI strategy is simply staying in the game.

The Power of Direct Booking Channels

One of the most effective ways to boost your return on investment is to reduce your reliance on third-party platforms. Building a robust direct booking channel—through a professional website, email marketing, and social media—allows you to own the customer relationship. When a guest books directly, you save the 15-20% commission that would otherwise go to an OTA, instantly increasing your profit margin on that stay.

This strategy requires a shift in mindset from “listing” to “branding.” By creating a unique brand identity for your villa and offering exclusive perks to direct bookers (like late checkout or free airport transfers), you incentivize guests to bypass the middlemen. Over time, a loyal base of repeat direct bookers provides a stable revenue floor that protects your ROI from OTA algorithm changes or fee hikes.

Risk Mitigation and Tax Compliance

Protecting your return on investment is just as important as growing it. Operating without proper licenses or tax compliance is a high-risk strategy that can lead to fines, back taxes, or even deportation. PT PMA companies are subject to corporate income tax and local levies; ensuring these are paid correctly is essential for the long-term viability of your business.

Additionally, structural risks like nominee arrangements can lead to total asset loss. By sticking to the compliant PT PMA path, you insulate yourself from these catastrophic risks. While compliance carries a cost, it is an insurance policy that ensures your revenue stream remains uninterrupted. In the maturing Bali market of 2026, legality is the ultimate competitive advantage.

FAQs about Bali Villa ROI

A typical return on investment ranges from 7-12%, with top-performing villas in prime areas reaching 15% or more. Fixed yields are market-dependent and unverified.

Foreigners cannot own freehold land. A PT PMA allows for secure Hak Guna Bangunan titles, which is the safest way to hold commercial property.

Yes, under BKPM Regulation 5/2025, land and building values can now be included in the investment plan for accommodation businesses.

Yes. Adjusting rates based on demand prevents revenue loss during low periods and captures maximum value during peaks, directly boosting your return on investment.

Direct bookings save you 15-20% in OTA commissions. This saving goes directly to your bottom line, increasing your net yield significantly.

Non-compliance can lead to heavy fines, interest penalties, and legal action, which will severely impact your effective return on investment and legal standing.